In Step 4, you project out the company's Income Statement, Balance Sheet and Cash Flow Statement, and determine how much debt is paid off each year, based on the available Cash Flow and the required Interest Payments.įinally, in Step 5, you make assumptions about the exit after several years, usually assuming an EBITDA Exit Multiple, and calculate the return based on how much equity is returned to the firm. This option has value on initial recognition even when it is out of the money. The fair value of the option comprises its time value and its intrinsic value, if any. Step 3 is to adjust the company's Balance Sheet for the new Debt and Equity figures, allocate the purchase price, and add in Goodwill & Other Intangibles on the Assets side to make everything balance. (b)The equity instrument is an embedded option to convert the liability into equity of the issuer.

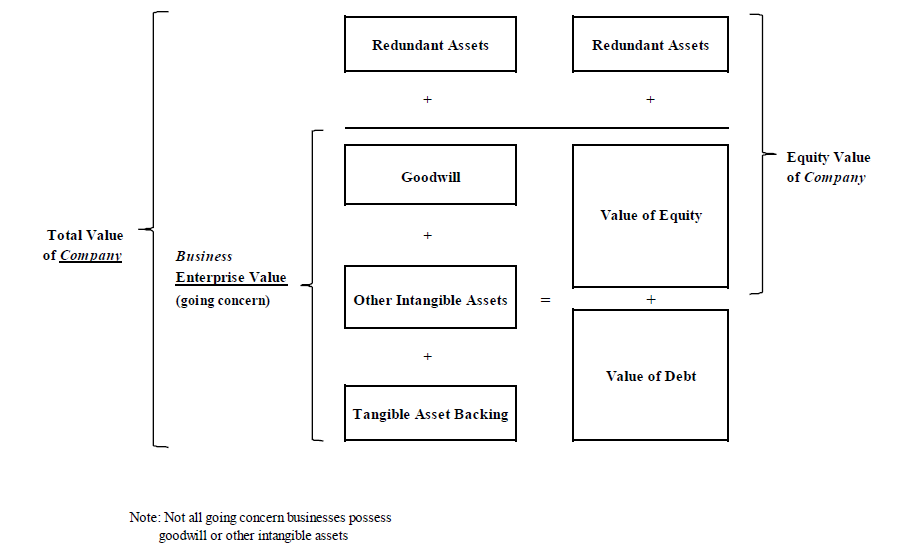

This is nice for simplicity, but it doesn’t give the control to the entrepreneur, which is why the convertible note looks to be the best choice for seed investment in this category. To convert enterprise value into equity value, subtract any nonequity claims, such as debt, unfunded retirement liabilities, capitalized operating leases, and outstanding employee options. Step 2 is to create a Sources & Uses section, which shows how the transaction is financed and what the capital is used for it also tells you how much Investor Equity (cash) is required. The SAFE can convert when you raise any amount of equity investment. Long story short: You can’t offer equity without knowing how much a share is worth. This valuation determines the cost to purchase a share. In such scenarios, convertible debtholders can use whichever option provides the best deal. A 409A is an independent appraisal of the fair market value (FMV) of a private company’s common stock, or the stock reserved for founders and employees. Since valuation caps and discounts offer complementary protections to investors, many convertible debt agreements include both features.

"In an LBO Model, Step 1 is making assumptions about the Purchase Price, Debt/Equity ratio, Interest Rate on Debt, and other variables you might also assume something about the company's operations, such as Revenue Growth or Margins, depending on how much information you have. Scenario 4: 5m Pre-money Valuation Cap, 20 Conversion Discount.

0 kommentar(er)

0 kommentar(er)